The EMV at-pump deadline has passed. Have you updated yet?

PCS is here to help you.

The PCS EMV at-pump Compliance Hub is our guide to help you navigate the gas station EMV chip deadline. We will continue to update this resource page with the latest EMV technology educational tools including videos, collateral, blog posts & more.

We would like to stress that while the deadline has passed, fuel merchants should make the effort to enable EMV acceptance if they have not done so already. These are major changes that take time and investment.

EMV Compliance Information Center

Technology Resources

- Gilbarco: COVID-19 C-Store Cleaning Tip: Turn Off Customer Signature Capture on Passport POS

- Current Software Version needed for EMV pump/dispensers: Verifone Commander, Version- 3.10.34 and Gilbarco. Version 12.02

Educational Documents

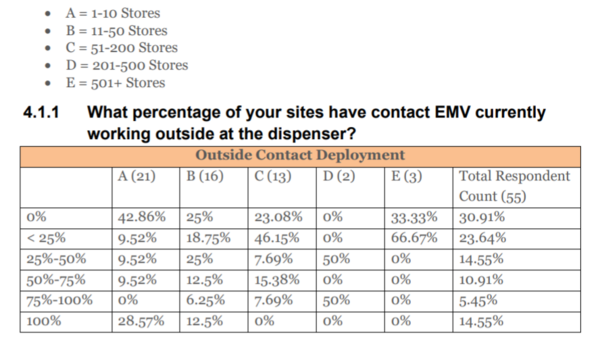

Fall Conexxus Survey Results

View Fall 2020 Conexxus EMV Survey (PDF)

Additional Survey Data

- C-store chains with more than 50 locations are the most likely candidates not to be 100% complaint at deadline.

- Of the largest c-store chains, 33.3% say they currently have no working EMV readers at the pump, while 66.7% have installed EMV at less than 25% of their pumps. Among chains with 51 to 200 locations, 46% have installed EMV readers at less than 25% of their pumps and 23% have yet to install them.

- Overall, 30% of respondents cite lack of software as a primary reason for their delay; 27% cite lack of certification for their EMV applications; and 13% cite lack of hardware.

- Complexity of deployment was cited by 27% as the primary reason for delaying deployment, while 34% cited myriad reasons for the delay, including Covid-19 and cash-flow management concerns.

- Cost of installation remains an issue, with 16% of respondents saying they still do not know how they will pay for EMV at the pump.

FAQ - Everything you need to know about the the EMV at-pump deadline

So, what do you need to know? As leading specialized providers in payment solutions, we compiled the following frequently asked questions to get you started.

Click each question to expand

The EMV Compliance deadline for VISA is set for April 17, 2021, but for Amex, Discover, and Mastercard, the date is April 16, 2021. Upgrading your automated fuel dispensers to ensure you’re protected against fraudulent transactions is key to limiting your business' liability. Let our experts walk you through the conversion process for your fuel dispensers and share the benefits of making the decision to upgrade ahead of the deadline.

The Europay, Mastercard, and Visa (EMV) protocol is the process of authenticating card present payments i.e. the security standard to prevent unauthorized use of a payment card at a terminal. For gas stations, the most significant upgrade on your current payment terminal is installing a chip card reader, which requires dipping to activate and has the security layer of requiring a number code to authenticate a payment.

There are several good reasons to make the EMV changeover, not the least of which is to remove liability for any chargebacks may occur at the terminal. Many independent gas stations are already liable to cover the cost of chargebacks, but there will be a clear distinction in liability once the deadline has passed; all merchants that comply with EMV standards will not be liable for chargebacks, and all merchants that do nor will be liable. The difference is cost could be significant. Additionally, using EMV systems means that gas stations are not only protecting themselves, they are also protecting their customers as EMV protocols all-but eliminate skimming. Thirdly, implementing these protocols may be a competitive differentiator for gas stations as chip cards become ever more ubiquitous and this impacts consumer experience accordingly.

No. EMV compliance is not a matter of federal, state, or even local law. And issuers will continue to process transactions processed via the old terminal, so gas stations that do not convert will still be able to accept payments at the pump. However, for companies who make the EMV changeover, credit card companies will assume the liability involved in a chargeback. For those who don't, chargeback liability will instead move to the individual gas station. So those who make the move to EMV compliance will protect themselves against being on the hook for fraud.

Predominantly EMV compliance means upgrading your credit card terminals and wiring to models that can accept payments via both EMV chip payment or via magnetic strip. That's it. It does, however, require all terminals to be so upgraded, a point which has left some business owners—like gas station owners who may have one terminal for every pump—concerned about the cost compared to the relative level of risk. Just because it's a simple task, however, doesn't make it easy or inexpensive; a large amount of cabling can be involved, and the hardware required can make this simple job very difficult to actually accomplish especially as the number of experts that can install the specific at-pump terminals is limited.

Be very cautious when it comes to accepting free hardware. There are, of course, some excellent merchant account providers that offer free hardware as an inducement to get new business in the door. However, there are also less scrupulous providers that are willing to eat the cost of hardware up front in exchange for other inducements down the line. Some who offer free hardware will also charge increased rates for processing payments, which will hurt profitability later. So be sure to review the entire deal package when considering an offer for free hardware; consult an attorney, accountant or similarly-qualified individual to get the full picture.

It is true that mobile wallets are gaining a lot of ground for users. It would be easy, therefore, to think that EMV isn't worth the bother, and that mobile wallets or in-app payments should be the focus for gas stations. However, adoption isn’t at critical levels yet and isn’t expecting to be any time soon; in skipping ahead to accepting NFC payments gas stations actively ignore a group of customers that are ready to pay now with EMV-based cards. These are actually most of the cards in play. So in planning for the future and bypassing a critical step, you send a large subclass of market directly to your competitors.

That depends on what pumps and CRINDS you currently have in place. Your local service company can help determine what is needed for you to be EMV compliant outside. If you do not have one we can recommend a couple of companies we have worked with in your area.

There are other, more cost-effective solutions such as Sound Payments and Invenco that provide a semi integrated, retro-fit kit typoe of upgrade.

The most common readers are the Verifone UX300 and the Wayne IxPay readers.

Refer to questions #1 answers. This is very site specific.

We have worked with petroleum technicians throughout the country and can provide some references in your area. Contact your sales rep or our corporate sales team for more information.

No, you will however be at a much greater risk of fraudulent activity at your location. Criminals will target non EMV sites. The April 17th, 2021 date is a liability shift just like we saw back in 2015 for inside EMV compliance. Branded sites currently have chargebacks covered by the branded networks such as Shell, Chevron, Conoco, etc.. This will change after that date if branded site owners are not EMV compliant. Unbranded locations already have the liability of paying for chargebacks but the incentive to upgrade is the dramatic increased risk of fraud.

Don't wait. Contact our expert team today to get started.

Request information about EMV at the pump.